As with many industries, the automotive sector is becoming increasingly dependent on innovative technologies such as IoT, AI and machine learning.

These advanced technologies incited automakers to develop a batch of next-generation vehicles, including autonomous, semi-autonomous and connected cars.

Even though modern cars offer a host of benefits in terms of safety, mobility and convenience, consumer privacy and security have become the primary concern for automakers.

As vehicles become more connected to the internet, software vulnerabilities become easily accessible to cybercriminals to exploit the consumers.

Unauthorized access to the vehicle network or control of critical safety systems can risk the user’s personal information and their physical safety.

In fact, some researchers have already demonstrated cyber-attacks on some cars.

- Two security researchers, Kevin Mahaffey and Marc Rogers, demonstrated that they could start the Tesla Model S car remotely, drive it, or cut its engine while someone else is driving.

- Two researchers Charlie Miller and Chris Valasek demonstrated that they could hack a Chrysler jeep, taking control over dashboard functions, steering, transmission, and brakes. Consequently, Chrysler recalled 1.4 million vehicles to fix the bug.

Thus, the technological advancement in vehicles has triggered the demand for automotive cybersecurity.

As per the market estimates, the global automotive cybersecurity market was valued at USD 1.44 billion in 2018 and is poised to reach USD 5.77 billion by 2025.

The automotive cyber security market is anticipated to propel at a CAGR of 21.4% during the forecast period 2019-25.

The adoption of cloud and mobile computing technologies is offering several growth avenues to the automotive cybersecurity market.

Moreover, the development of open-car standard interfaces, mobile cross platforms, automotive data taxonomy, and intelligent transport systems fuels the demand in the market.

RELATED: 8 Industries Where Compliance Calls for an MSSP in US

Application Security Segment to Accelerate at Highest Rate

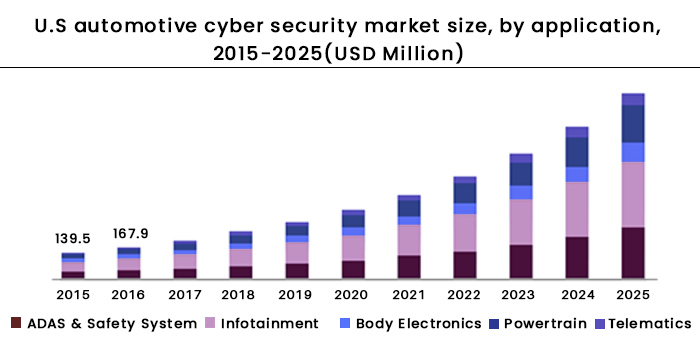

Based on security, the automotive cybersecurity market is bifurcated into endpoint security, application security and wireless network security.

Among them, the network security segment is expected to hold the highest share in the global market. The segment is driven by the increasing probability of cyberattacks in the network interfaces with the growing internal and external networks of connected cars.

However, the application security segment is anticipated to witness the highest CAGR of 23.4% from 2019 to 2025.

Electrical Vehicles Driving the Demand

Based on the vehicle type, the market is categorized into commercial vehicle, passenger car and Electrical Vehicle (EV). The passenger vehicle segment dominated the automotive cybersecurity market, with the highest market share in 2018.

The increasing consumer preference for in-vehicle connectivity, such as infotainment, mobile phone connectivity, navigation, voice recognition, and external communication, drives the segment’s growth.

Meanwhile, the EV segment is expected to register the highest CAGR during the forecast period. This is mainly due to the increasing sales of EVs in potential marketplaces such as the US and Europe. For instance, the recently launched Tesla Model 3 witnessed high sales in the US.

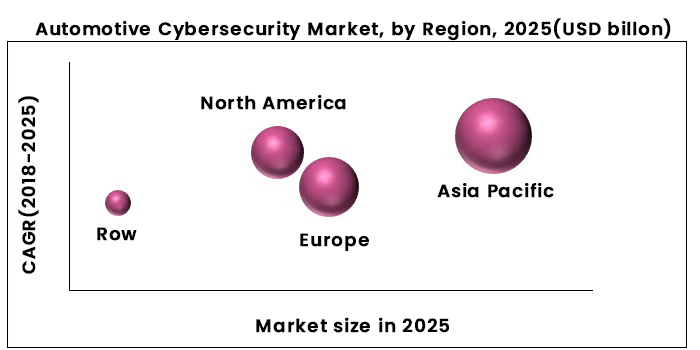

North America at the Forefront of the Automotive Cyber Security Market

Regionally, North America is considered to hold the majority share of the global automotive cybersecurity market due to the high demand for modern automobiles.

The convergence of automotive companies and the ICT giants such as Google or Apple has led to the advent of the connected vehicle ecosystem.

The US connected car commerce is expected to grow from USD 2.25 billion in 2018 to USD 16.43 billion by 2023, with a CAGR of 48.8%.

Moreover, the reinforcement of mandates by regulatory bodies for vehicular protection in North America has increased the focus of the automakers on cybersecurity solutions and regulations.

RELATED: What is Cyber Security for Connected Cars?

For instance, The Security and Privacy in Your (SPY) Car Act in the US mandates that critical software systems in cars are safeguarded against cybersecurity threats. It also mandates that the data stored in the car should be secured to prevent unauthorized access and data breaches.